On January 1, 2022, Alberta will be adopting the Direct Compensation for Property Damage (DCPD) system. This new system aims to improve the way Alberta’s insurance companies support their customers in the event of a collision loss.

How Does It Work?

Under this new system, in the event of a not at-fault collision loss, your own insurance company will pay for repairs to your vehicle. Prior to January 1, 2022, the at-fault party’s insurance company would be responsible for paying the repairs.

What Is The Reason For The Change?

DCPD is being introduced into Alberta as a fairer and more customer-focused approach to handling not at-fault collision claims. Under this system, your vehicle will be repaired faster and without the delays that often come with dealing with another party’s insurance company. Many other provinces currently and successfully use the DCPD system.

How Do You Prepare?

There is nothing that you need to do. DCPD is a change in the way vehicle damage claims are handled by the insurance companies in Alberta.

How Will This Impact You?

DCPD aligns automobile insurance premiums with the costs associated with vehicle repairs. Typically, a vehicle owner with a less expensive vehicle that costs less to repair will be paying less for their insurance premiums. On the flip side, a vehicle owner with a more expensive vehicle that costs more to repair will be paying more for their insurance premiums.

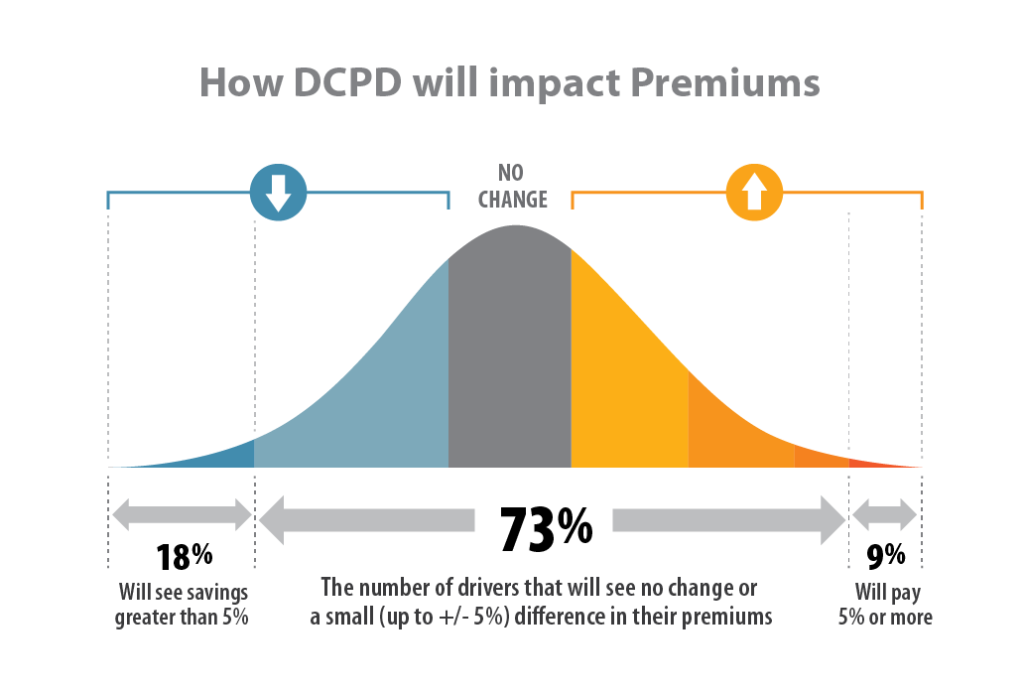

The below chart outlines how DCPD will impact premiums overall, with 42% of drivers seeing a reduction in premiums, 15% of drivers seeing no change, and 34% of drivers seeing an increase.

For more information on Alberta’s new DCPD system that takes effect January 1, 2022, please visit the Insurance Bureau of Canada’s website, or check out their great FAQ sheet.

As always, if you have any questions on how this will impact your current automobile insurance policy, one of our friendly Brokers would be more than happy to assist you.

Thank you,

The Costen Insurance Team