When traveling out of the country or out of your home province, Travel Insurance can help protect you and your family from unexpected costs due to a medical emergency, allowing you to customize your protection for unforeseen circumstances such as lost baggage, trip interruption, or trip cancellation.

Whether you are a Canadian Resident, a Visitor to Canada, an International Student, or a Canadian Expatriate, travel insurance can help safeguard you and your family.

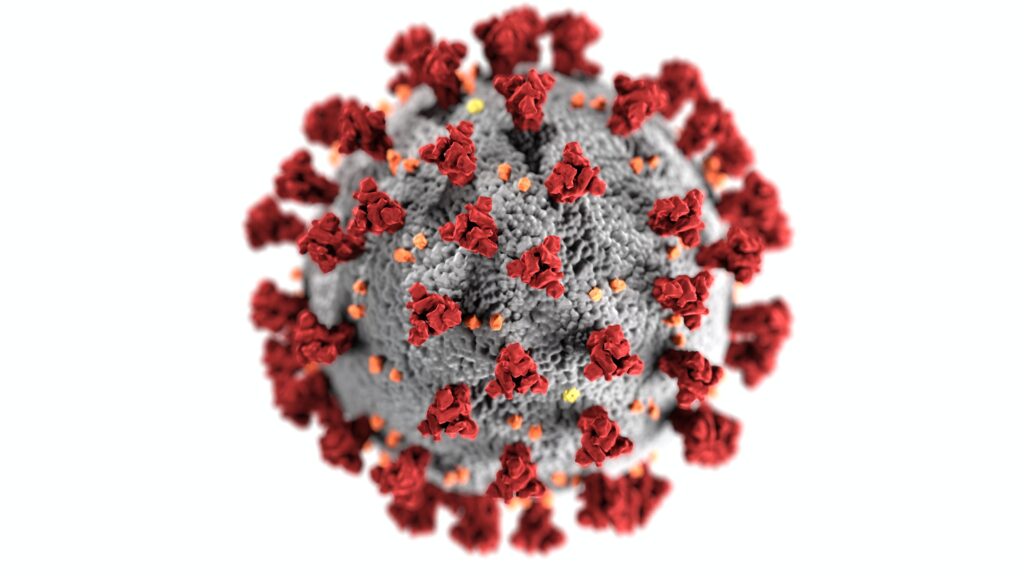

With the current COVID-19 Pandemic, there is an added risk to traveling. What if you get sick or hospitalized while you are away from home? Several travel insurers are now offering COVID-19 travel insurance plans that can be purchased in addition to your regular travel coverage.

Emergency Hospital & Medical Coverage

Below is a list of common features and benefits found in most Hospital and Medical Travel Insurance policies for Canadians:

$5,000,000-$10,000,000 in Emergency Hospital and Medical coverage, which includes:

- Accidental and Emergency Dental

- Ambulance Services

- Attendant

- Prescription Medication

- Emergency Transportation

- Meals and Accommodation

- Return to original Trip Destination

- Return of Traveling Companion

- And much more!

24/7 access to emergency assistance (multi-lingual)

All-inclusive plans and multi-trip plans available

Assistance with lost or stolen travel documents

Below is a list of some of the most common Optional Plans available:

Baggage – Covers the cost to replace lost, stolen or damaged belongings

Trip Cancellation & Interruption – Reimbursement of the non-refundable portion of the trip if it is cancelled, interrupted or delayed for a specific reason (as listed in the policy)

Air Flight Accident – Covers the loss of life, limb or sight, or disappearance resulting from an aircraft accident

Accident Death & Dismemberment – Covers the loss of life, limb or sight, or disappearance during your trip (other than while flying)

Rental Car Collision Damage – Provides coverage for the physical damage to an automobile rented from a commercial rental car agency (worldwide)

Most Travel Insurance plans provide exclusions for pre-existing medical conditions, and may have a requirement of a specific number of days of stability in order for such conditions to be covered. Medically underwritten plans are also available for those who may have an existing medical condition that may otherwise not be covered.

COVID-19 Insurance and Assistance Plan

As travel destinations start to open up, it is important to consider what could happen if you or a family member contracts COVID-19 while traveling abroad. Several travel insurers are now providing the option to purchase travel protection for emergency medical and quarantine costs related to COVID-19 while traveling.

Below is a list of what can be covered under a COVID-19 travel insurance plan:

Emergency Treatment – medical expenses related to the treatment of COVID-19 after receiving a positive COVID-19 test.

Transportation – expenses incurred for transportation to the nearest medical facility or to a Canadian hospital.

Return of Travel Companion – in the event an insured is quarantined, hospitalized or repatriated, this benefit covers expenses to transport a travel companion and dependent children back to their home.

Expenses in the Event of Death – in the event of death due to COVID-19 while abroad, this benefit provides coverage for preparation and transportation of remains.

Quarantine Meals & Accommodation – provides coverage for expenses if insured is placed in quarantine during their trip due to a positive COVID-19 test.

Denied Boarding – if the insured is denied boarding due COVID-19 screening, the benefit will cover unexpected expenses incurred due to the delay.

There are certain eligibility requirements that must be met prior to purchasing a COVID-19 travel insurance policy. In addition, travel advisories can impact the availability for coverage. For more information, please contact us!

There are many good reasons why we recommend our clients purchase Travel Insurance when traveling out of province or out of country, and to summarize (courtesy of www.today.com), here is a list of the top nine most common ones:

1. Your flight has been cancelled.

2. Your bags are lost and your medication is in it. You need to have an emergency prescription filled.

3. Your passport and wallet are stolen, and you need emergency cash and a replacement passport.

4. You’re involved in an accident and adequate medical treatment is not available. You need medical evacuation.

5. You need to cancel your trip due to illness.

6. Your cruise line, airline or tour operator goes bankrupt. You need your non-refundable expenses covered and to get to your destination.

7. You have a medical emergency in a foreign country.

8. A terrorist incident occurs in the city where you’re planning to visit and you want to cancel your trip.

9. A hurricane forces you to evacuate your resort, hotel or cruise.

And our #10 reason why we recommend our clients purchase Travel Insurance:

10. It is inexpensive and can save you and your family from unnecessary financial and emotional hardship!

For more information or if you have any questions regarding the Travel Insurance products that are available to you, please do not hesitate to contact us and one of our knowledgeable Insurance Brokers would be more than happy to assist you!

Thank you,

The Costen Insurance Team

PS – Traveling soon? Check out the most up-to-date information on travel advisories, and more here.